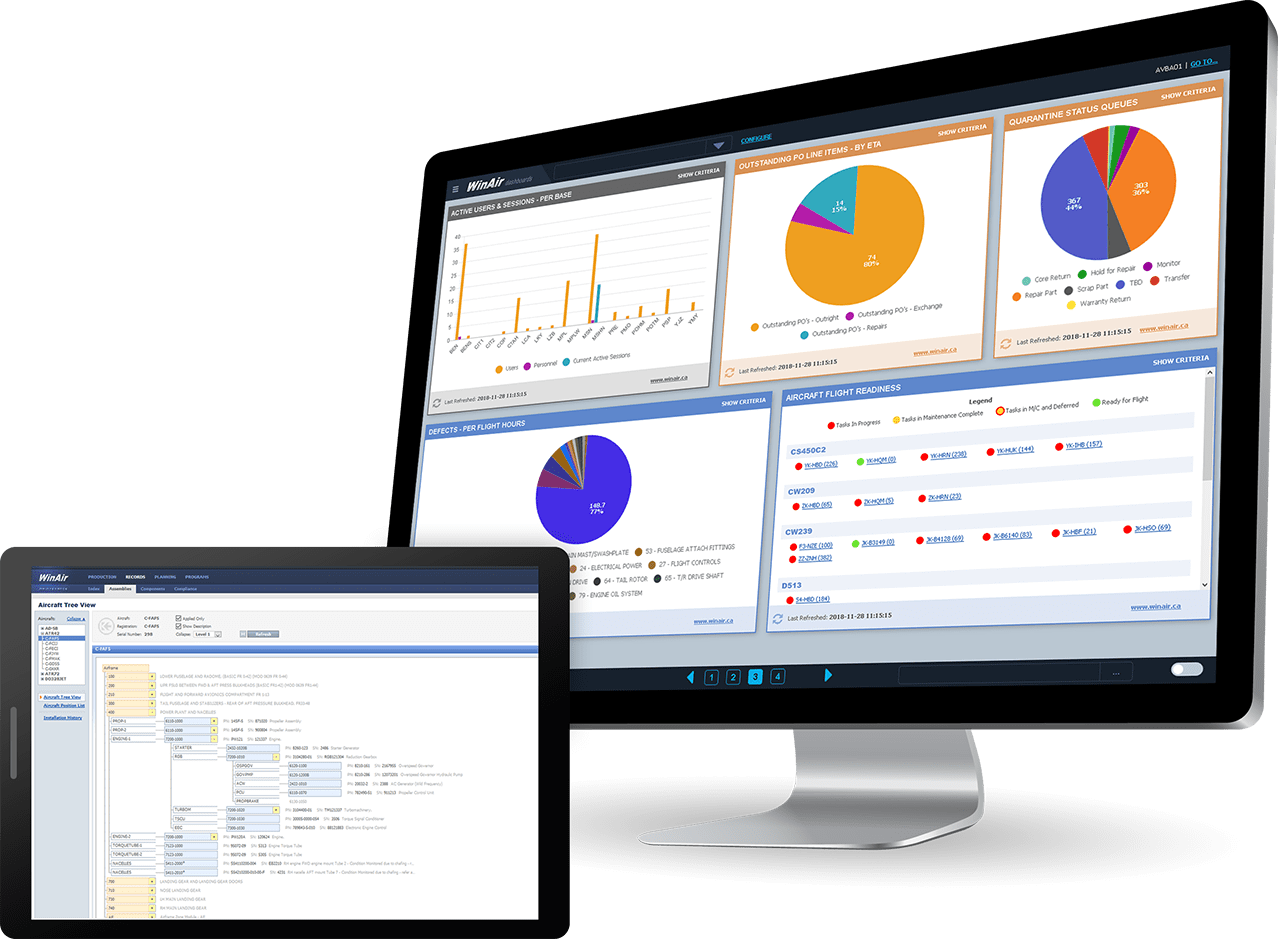

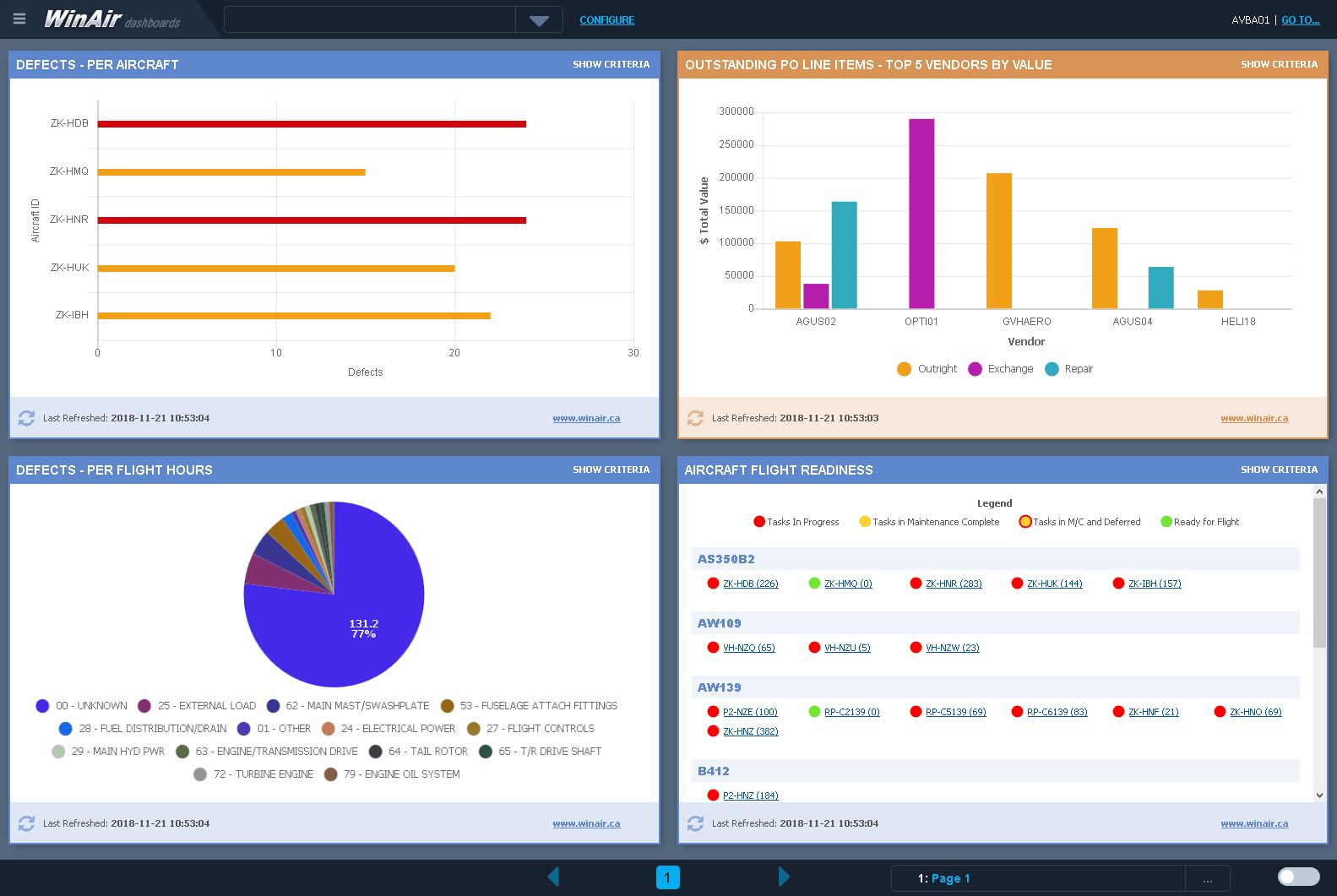

Leader in Aviation Management Software

WinAir is the top pick for organizations concerned with reliability, compliance, and having access to data they can trust. The company has over 30 years of experience as a leader in aviation management software. Businesses world-wide rely on WinAir to efficiently and effectively track and manage their aircraft maintenance and inventory control.

With the latest release of the software, WinAir Version 7, WinAir's clientele are benefiting from a bottom-up approach to aviation maintenance management that follows actual industry best practices. This makes it easy for users to quickly embrace the software, grasp the product knowledge, and accurately provide comprehensive data to management.

Packages

Let WinAir streamline your processes, improve the accuracy of your reporting, and find savings in your maintenance budget. No matter your operation's type or business size, we have the right package for you.

Operator

Airlines, Charters, Special Mission Operators, and Continuing Airworthiness Management Organizations (CAMOs) all require the ability to manage complex maintenance and logistics demands efficiently and effectively. A software solution is now an essential component in ensuring that you are making the best possible decisions for your business.

Heliops

Civil and military helicopter organizations deploy their fleets across the globe in varying conditions, and in some of the most demanding environments. In order to meet the unique requirements of heliops, the software must be robust, versatile, and accessible worldwide.

MRO

The global demand for Maintenance and Repair Organizations (MROs) is on the rise and industry knowledge indicates that it is expected to continue to grow over the next decade. MROs require adaptable software solutions to accommodate for growth, and to allow for greater revenue and profitability.

Our Global Client Base

WinAir is proud to serve hundreds of aviation operations in over 30 countries worldwide. Companies using WinAir conduct business out of bases located in some of the most remote regions of the earth. Our software is the solution of choice for over 15,000 end users, who manage the maintenance activities on more than 9,000 aircraft.

Serving

30

Countries Worldwide

Solution of Choice for Over

15000

End Users

Manage More Than

9000

Aircraft

Go Digital: Integrate, Streamline, and Save

Managing an aviation operation is challenging. At WinAir, we understand the unique requirements of fixed-wing, rotary-wing, and mixed-fleet operations, along with the specific needs of MROs and CAMOs. We know all about the challenges that these industry types face when they are managing their business without the appropriate tools.

Let WinAir help your company go digital by integrating your departments, streamlining your processes, and saving you time as a result of automated procedures. This allows you to focus your efforts on what matters most: overseeing your daily business practices and improving your bottom line.

Start your journey with WinAir today

Contact us now to speak with a WinAir Solutions Representative about your operation's unique specifications.

Services

Process Consultation

Discover how our complete end-to-end assessment can improve your business and boost overall efficiencies.

Project Management

Have our dedicated project management team guide you through a simple and seamless WinAir implementation process.

Data Migration

Let our team expedite the implementation process by performing the compliance, data loading, and inventory data import into WinAir.

Training

Learn through our multi-tiered approach to training that is tailored to your business' unique needs and particular budgetary requirements.

Aircraft Template Services

Capitalize on over 30 years of aviation industry experience and get a head start on your implementation with our Aircraft Template Services.

Hosting

Trust in our experienced IT team and protected cloud environment to keep your data safe, secure, and always available from anywhere in the world.

Integrations

Connect WinAir with your accounting software and flight ops system to improve operational transparency and increase efficiency on maintenance tasks.

Client Success

Partner with a team that is committed to your success, every step of the way—we provide our clients with a variety of support mechanisms and set them up with a dedicated Client Advocate.

What Our Clients Say

Hear From Our Clients

WinAir has clients from around the globe that operate in a variety of aviation industries—from airlines to helicopter operators, law enforcement agencies, oil industry suppliers, Maintenance Repair Organizations (MROs), Continuing Airworthiness Maintenance Organizations (CAMOs), medical evaluation response teams, and more. For these aviation companies, WinAir has proven to be a critical component to the successful management of their fleet maintenance programs. Don't just take our word for it. In our Customer Stories video, learn more about what our clients have to say about their experience using our software.